Trusts: the different types and their benefits

Many of our clients have a business structure that involves a trust and whilst the common response is “sounds great” ...

What’s the Main Residence Exemption?

Property is a fickle beast when it comes to tax implications and the most common question or situation that arises ...

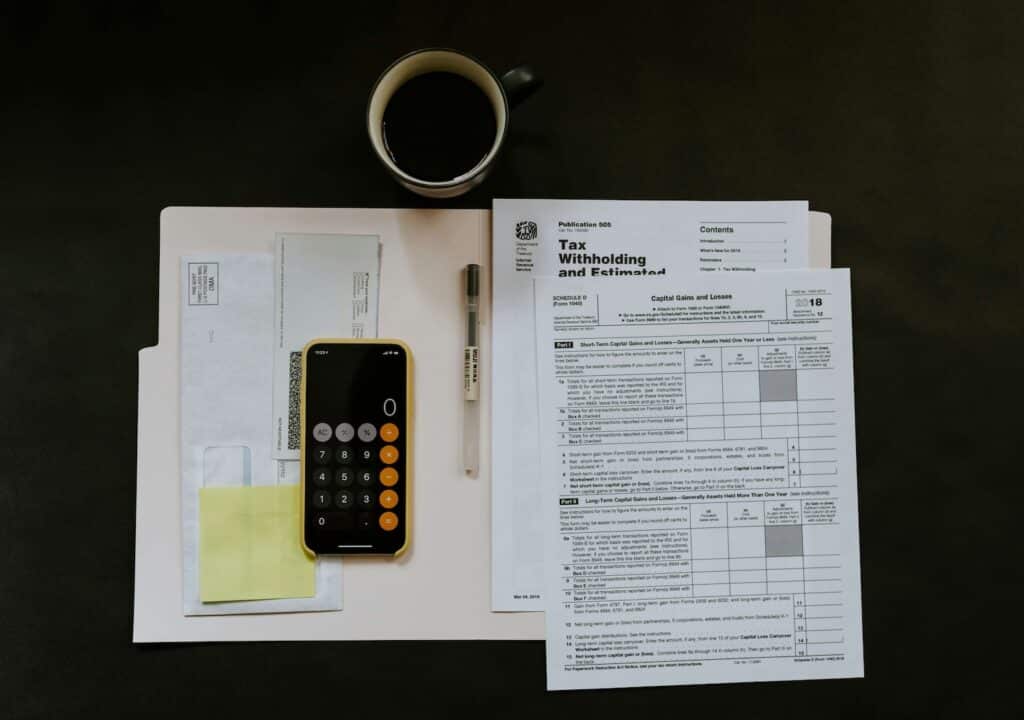

What to Know About ATO Remissions

One of the reasons it’s so important for us to work with clients, making sure what needs to be lodged ...

What you need to know about the latest tax cuts

You might have heard that PM Anthony Albanese’s government has made a few (significant!) tweaks to the planned tax cuts ...

PAYGI Explained

With endless terms and dates to remember when it comes to tax as a business owner, it can be hard ...

Everything you need to know about the Paid Parental Leave Scheme

You might be expecting your first, planning for pregnancy or be one or two kids in already but either way, ...

Annual Compliance Reminders To Consider This Month

We hope that you’re reading this with a cold glass of something in your hand because while we applaud your ...

Interview: The Memo

If you ask most parents “have you heard of The Memo?” you’ll get a resounding “Yes!”. A parenting and baby ...

What Meals, Entertainment and Travel Can I Claim This Christmas?

The silly season has arrived at a particularly alarm rate this year and whilst the end of the calendar year ...

The 2023 Future Advisory Gift Guide

It’s time for one of our favourite yearly blogs – the Gift Guide! Either this or the Federal Budget blog, ...