What The New Superannuation Tax Changes Could Mean For You

If you’ve been keeping an eye on the news (or your super balance), you might’ve heard about the Labor Government’s ...

What Construction Businesses Need To Know About LeavePlus

If you own a business in the construction industry, this one’s a must-read. To meet compliance standards you need to ...

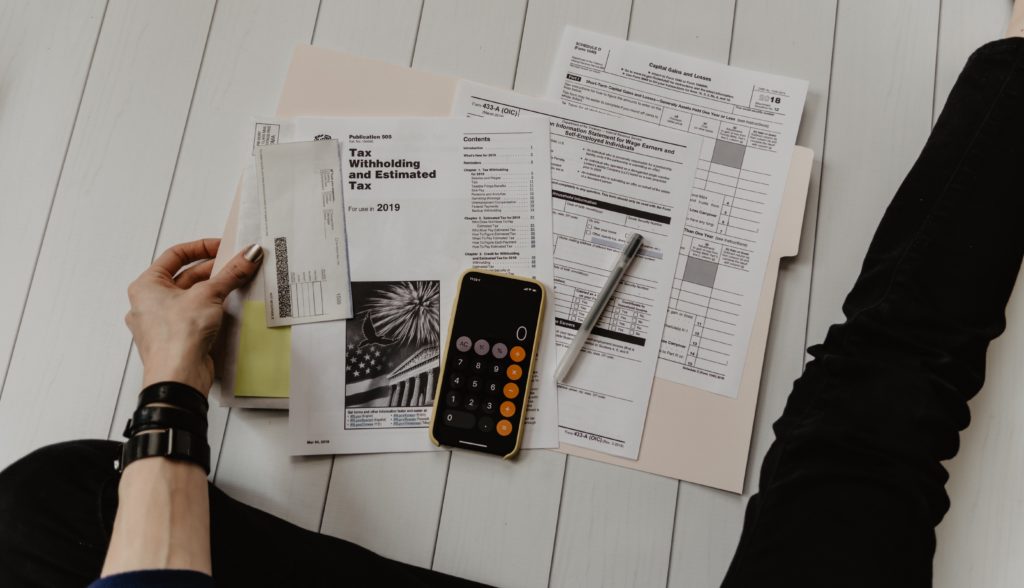

Why 2025 Tax Planning Is So Important For Your Business

Tax planning for our business clients is the nuts and bolts of what we do. It involves going through your ...

The 2025 Federal Budget Recap

Wake up, it’s Federal Budget time! Perhaps our highlight of this year’s budget announcement – which was handed down by ...

What You Need to Know About Fringe Benefits Tax in 2025

Fringe Benefits Tax seems to be one of those accounting terms that never stick. If we had a dollar for ...

The Numbers Game 2024: A recent episode recap for the Future Fam

We know lots of the Future Fam are avid The Numbers Game listeners… and if you’re not, why not!? Jase ...

Accounting for Doctors: Mastering Medical Services Financial Management

What’s up, doc! If you feel like you’re drowning in a sea of numbers when you should be focusing on ...

7 Best Accounting Software for Small and Medium Businesses in Australia

Assuming that if you’re running a small or medium-sized enterprise (SME) in Australia, you’ve probably found yourself drowning in a ...

Your Guide to Choosing the Right Accounting Firm for Business Success

Are you feeling a bit overwhelmed by the thought of choosing an accounting firm for your business? Don’t worry – ...

Step-by-Step eCommerce Accounting: Simplify Your Online Business Finance

Melburnian entrepreneurs know that running an online business comes with unique financial challenges. Proper eCommerce accounting can help streamline your ...