How the Logbook Method Works for Vehicle Claims in Australia

Often, one of the biggest perks of owning a business, or being an employee that has to use your vehicle for work, is being able to write off your car and its seemingly never-ending costs as tax deductions. Whilst this is largely true – there’s a misconception that you can either claim 100% of the expenses (unless your industry specifically demands it, this isn’t correct) or that you don’t need to keep records.

Logbooks are at the top of our nagging list pre and post-tax return meetings. They’re something that most people still don’t keep. Still, with recent ATO changes, logbooks are necessary to complete your end-of-year returns (whether you’re a business owner or an individual looking to claim car expenses as a tax write-off).

Here’s everything you need to know about logbooks: what they are, why you need one, and the easiest ways to keep one.

What is a logbook?

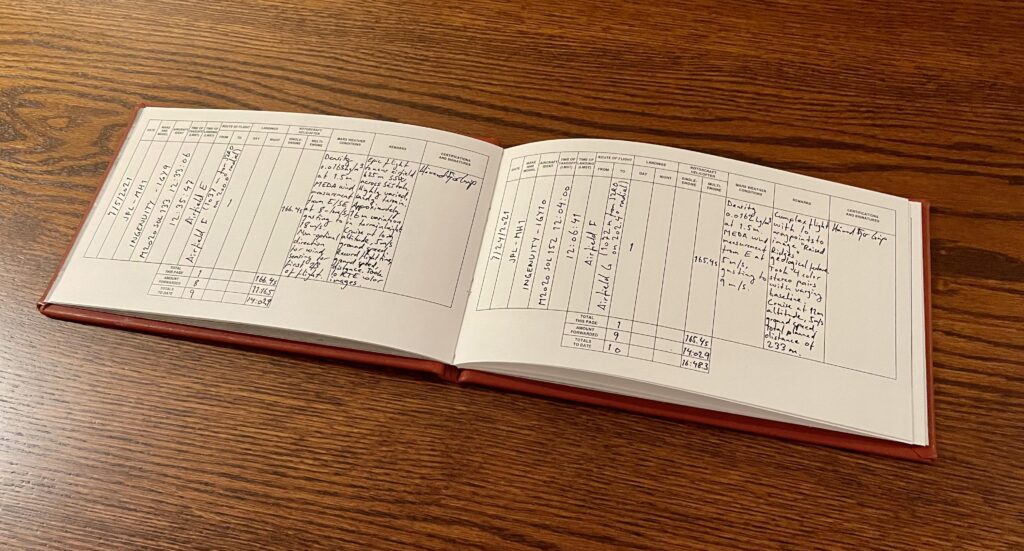

A motor vehicle logbook records all your vehicle use for 12 consecutive weeks, tracking all personal and business trips. This information is required to claim tax deductions for your motor vehicle using the Logbook Method rather than the Cents Per Kilometer Method, which requires diary entries and no receipts. Read on to understand why it’s beneficial to go to the extra effort of a vehicle logbook…

Why do I need to keep a logbook vehicle?

If you use your car for business or work purposes, you need a logbook to maximise your claims and get the best tax deduction outcomes for your circumstances. If you wish to claim a tax deduction for all costs related to your vehicle, including registration, insurance, repairs and maintenance, interest on finance, and depreciation – you need a vehicle logbook. Without one, you are not able to claim these expenses. You must keep all receipts and records even if you have your 12-week logbook. You can read about the best ways to record keep over here on a previous blog.

For example: if you drive approximately 5000 km for work purposes, it may be simpler for you to stick to the cents per kilometre method; however, if you regularly use your vehicle for business or work travel, more than 5000 km, we highly recommend keeping a logbook for tax purposes.

What Are The Benefits of Keeping Vehicle Logbooks?

Keeping a vehicle logbook might seem like just another task on your to-do list, but it’s so much more than meeting ATO requirements. It’s your ticket to unlocking a range of benefits for both individuals and businesses. Let’s break down the perks of maintaining an accurate and detailed logbook:

Maximise Tax Deductions with Accurate Records

Who doesn’t love saving money? With a well-maintained logbook, you can significantly boost your tax deductions. It’s all about keeping precise records of how much you use your vehicle for business purposes. Here’s what you can claim:

- Fuel Costs: Every litre of petrol you burn for work-related travel is money you can get back.

- Maintenance and Repairs: Whether it’s regular servicing, new tyres, or unexpected fixes, these expenses are deductible.

- Insurance and Registration: Your logbook helps you correctly divide these annual costs between personal and work use.

- Loan Interest or Lease Payments: Financing your vehicle? You can claim the portion related to business use too!

For example, if your logbook shows that 70% of your vehicle use is for business, you can claim 70% of all related expenses. It’s an easy way to ensure you’re getting the most out of your eligible deductions and not leaving any money behind.

Optimise Fleet Management with Comprehensive Logbooks

Logbooks are the best assistance for managing your vehicle fleet if you’re running a business with multiple vehicles. By recording essential details like vehicle mileage, routes, and fuel use, you can:

- Monitor Efficiency: Spot inefficient routes or high fuel consumption and make adjustments.

- Streamline Maintenance: Stay ahead of repairs and keep your vehicles in top condition.

- Improve Cost Allocation: Identify the most cost-effective vehicles and allocate resources smartly.

- Enhance Accountability: With clear records, you can ensure drivers follow policies and use vehicles responsibly.

With this data at your fingertips, you can cut unnecessary costs, boost productivity, and even extend the lifespan of your vehicles—all while staying compliant with ATO tax rules.

Legal Protection During Tax Audits

Let’s be honest—nobody likes the idea of an ATO audit. But your logbook can be your safety net if the ATO ever comes knocking. Here’s why:

- Compliance with ATO Standards: A thorough logbook proves your claims are accurate and meet tax requirements.

- Minimising Penalties: Forgetting or having incomplete records can lead to rejected claims or fines. A logbook helps you avoid these headaches.

- Demonstrating Transparency: Keeping detailed logs shows you’re honest and upfront about your business vehicle usage.

For example, during an ATO audit, the ATO may request evidence of your vehicle’s business usage. A complete logbook that records every trip—along with receipts and maintenance records—can save you from stressful back-and-forth disputes and potential financial loss.

Business vs. Personal Vehicle Logbooks: What’s the Difference?

Business and personal vehicle logbooks serve different purposes but are equally important.

- A business vehicle logbook tracks the business-related usage of a company-owned vehicle. It includes details like client visits, deliveries, or travel between offices.

- A personal vehicle logbook, used for claiming work-related expenses on a privately owned car, must clearly differentiate between personal and business trips.

Here’s a table comparing business and personal vehicle logbooks in detail.

| Feature | Personal Vehicle Logbook | Business Vehicle Logbook |

| Purpose | Primarily for personal use, but may be used for occasional business trips. | To track business use of a vehicle for tax deduction purposes. |

| Required by | Not mandatory, but recommended for personal record-keeping. | Australian Taxation Office (ATO) for claiming car expenses. |

| Record-keeping | No specific requirements, but can be useful for tracking expenses and mileage. | Must be kept for at least 12 continuous weeks to establish a business-use percentage. |

| Deductions | Limited deductions may be available for business trips, but primarily for personal use. | Allows for claiming a portion of car expenses based on the business-use percentage. |

| Fringe Benefits Tax (FBT) | Not applicable. | Relevant for company-owned vehicles used by employees. The logbook helps determine the FBT liability. |

What happens if I don’t keep a logbook?

If you don’t keep a logbook, you’ll still need to record your kilometres to claim the cents per kilometre method, giving you a maximum deduction of $3,600 (5000 km x 0.72 cents for 2022, increasing to 78 cents or $3,900 for 2023).

If you fail to keep a diary or logbook, unfortunately, you will not be able to claim a deduction for using your vehicle.

What kind of vehicle use is considered tax deductible?

Some commonly claimed travel expenses include:

- Driving between two places of work (you cannot claim expenses for travelling between your home and workplace*)

- Driving between your place of work and a client meeting, whether at their office or elsewhere

- *If your place of work changes regularly, you may be able to claim expenses incurred driving between your home and work. The other scenario where this is applicable is if you’re transporting heavy, bulky pieces of equipment (common for many tradies)

For a detailed guide tailored to tradies, check out this simplified guide to accounting for tradies.

The ATO has a very helpful, long list of claimable travel expenses and several examples over here.

We’d also recommend having a squiz at this list of expenses you cannot claim, before you start your logbook! The common mistakes include:

- Long drives from home to work

- Trying to claim trips that are outside of usual working hours (shift, night duty or on-call)

- Doing minor work activities on your way to or from work, like picking up the mail

What are the different ways of keeping a vehicle logbook?

The critical takeaway is to keep your logbook in a way that suits you. Whatever you’re likely to stick with, do it. It might be a pen and paper that’s scribbled on every time you get in and out of the car, an excel spreadsheet, a diary or an app.

Being a tech-savvy accounting firm – we love an app – Driversnote is our app of choice.

If you prefer a spreadsheet, the driver’s note has a great template to follow, but please include a detailed purpose for each journey, not just “business” or “personal”. If you prefer the old pen and paper method, you can still record all your trips in a logbook at your local newsagent!

Here’s a free Future Advisory template you can download straight away.

Finally, the ATO have their app too. You can find that here.

What needs to be included in a vehicle logbook?

The logbook needs to show every trip you take over that period – work or personal. Here’s what needs to be included in each entry:

- Date

- Start and finish times

- Start and finish odometer readings

- The reason for each drive, in detail! For instance, driving to meeting Future for 22/23FY tax planning or going to get grocery shopping.

- Total number of kms driven

- Start and finish dates, odometer readings and kms travelled for the total logbook period.

- Calculate the business use percentage for the period

Next time we see you for a tax planning or tax return meeting, we look forward to seeing your impeccable logbooks 😉 As always, we’re here to answer any questions you may have.

FAQ

Can I Use a Single Logbook for Multiple Vehicles?

No, you’ll need a separate logbook for each vehicle. The ATO requires individual records for each vehicle’s business use to ensure accuracy. If you use multiple cars or motorbikes for work, keep a unique logbook for each one to properly track trips, costs, and deductions.

How Long Should I Keep My Vehicle Logbook Records?

Keep your logbook and supporting documents for five years from the end of the financial year you claim deductions. A 12-week logbook remains valid for up to five years, as long as your vehicle usage doesn’t change significantly. Stay organised to avoid future hassles with audits!