The Federal Budget Breakdown

That time of year is here again; accountants on the edge of their seats, financial advisors getting the popcorn out and 98% of the population wondering what on earth it all means. 2020 has left the country with a huge debt thanks to the mate we all love to hate: coronavirus.

It left Scomo and his party with a very difficult problem to (attempt to) solve: how do we get the Australian economy resembling anything close to healthy again? Frydenberg’s announcements were based on an essential assumption – that the population will be vaccinated against C-19 by the end of 2021. Cross your fingers and toes people!

We’ve broken the budget down into easily digestible bits for business and individuals. Here we go…

Instant Asset Write Off Replaced With Bigger Scheme

- Immediate tax deductions for any depreciable asset purchase, for businesses with a turnover of up to $5 billion

- There is NO dollar limit

- Applicable to purchases from 6 October 2020, to June 30 2022

Tax Offset For Business

- Any company who makes a loss up to the 21/22 financial year will be able to offset this against profits made after 18/19, to generate a refund from the tax office. We bet those are words you’d never thought you’d hear as a business owner!

JobMaker

- If you need to hire, now is a great time. Employers who hire anyone on the JobSeeker program will receive $200 per week for people under 30 and $100 per week for those ages 30 to 35. Employees must be working a minimum of 20 hours a week.

- Read more about this HUGE initiative here

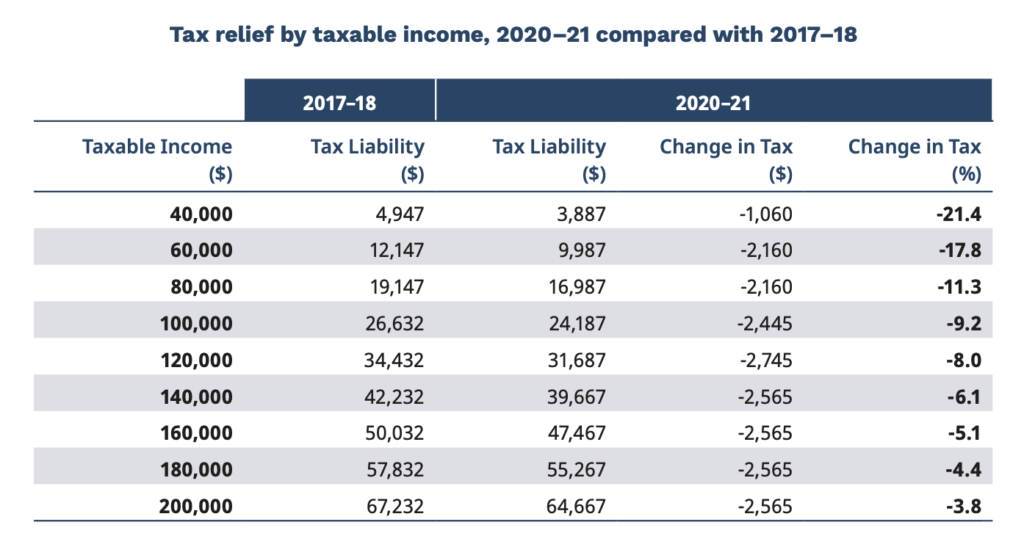

Income Tax Cuts

- Remember the tax cuts roll out they announced last year? It’s been brought forward by two years, to be backdated to July 1 this year

- The 19% tax rate will be applicable to those earning up to $45k, and 32.5% for incomes up to $120k

- The $1080 payment for low to middle income earners will extend for another year

- The third stage of the plan will remain as previously stated, to roll out in 2024

What does this mean in practical terms…

Those earning up to $37,000 will be $510 better off;

between $37,001 and $48,000 will be between $510 and $2160 better off;

between $48,001 and $90,000 will be between $2160 and $2295 better off;

between $90,001 and $126,000 will be $2295 and $2745 better off

Wage Subsidies For Apprentices & Trainees

- Subsidies will be extended for new hires

- Boosting Apprenticeships Wage Subsidy will pay a 50% wage subsidy, up to a cap of $7,000 per quarter

Mental Health

- The previously announced 20 medicare-subsidised psychology sessions available to all Australians, doubled from the usual 10, has now been extended for the rest of next year rather than ending in March as previously planned

No Extension For JobKeeper & JobSeeker

- JobKeeper is still scheduled to end in March 2021, and JobSeeker in December 2020 as the government clearly looks to invest in growth rather than maintain support measures

Here’s some more reading if you’re interested in seeing the full budget picture:

If you like graphics, this article is for you.

The budget in its entirety straight from the government.

Winners and losers in this budget.

An extended article here.

Questions? Concerns? Dad jokes? Send them our way.