Three new tech platforms business owners need to know about

If you’ve been here for more than five minutes, you know we are some of Xero’s biggest fans – and we love a bit of business tech in general. Apps and software form a big part of our business advisory services because we know the difference perfectly suited technology can make to processes and cashflow. It’s about finding the right fit.

Here are three new apps that we’ve just learnt about, that talk to Xero, and that we think you might find very handy.

Airwallex

If your business knows no borders, Airwallex is for you. Airwallex is a multi-currency platform that allows businesses of all sizes to trade internationally without the long transaction processing times, hefty conversion fees and mega confusion.

With the Airwallex app, you can collect and hold funds in more than 11 currencies with zero transaction fees (win!). The team at Airwallex also claims to offer exchange rates up to 90 per cent cheaper than banks, which is a big deal if you’re regularly trading overseas.

If you sell services or products internationally, Airwallex allows you to accept local payment methods from all over the world and settle them in whichever currency suits you. You can also pay international bills and create international bank accounts, all in this globe-trotting app. Another cool feature is free access to “borderless” multi-currency visa cards that can be added straight to your Apple wallet and ready to use in a flash.

Airwallex has some pretty cool mates too. Our mutual friend, Xero, allows Airwallex users to seamlessly integrate bank feeds into their software. The Airwallex rewards system also offers users exclusive discounts with some of their other mates like Amazon, LinkedIn and Office 365.

Divipay

What is Divipay? Divipay is a masterstroke in managing team business expenses and allows business owners to set up team budgets and fortnightly or weekly spending limits that link to virtual corporate cards for their teams.

The virtual cards can be added to Apple wallets just like a regular Visa or MasterCard can and can be managed remotely by business owners or other team members assigned to the job. That person can then set budgets for specific team members, approve budget requests and keep track of who is spending and what they’re spending on with a comprehensive transaction history right at your fingertips.

The nifty app also tracks reimbursements, can automate payments and manage recurring subscriptions. Just like with Airwallex, transaction data and receipts are reported automatically into Xero, saving you the legwork.

We love it because it’s a seamless way to keep track of the spending and budget of your teams all in one platform.

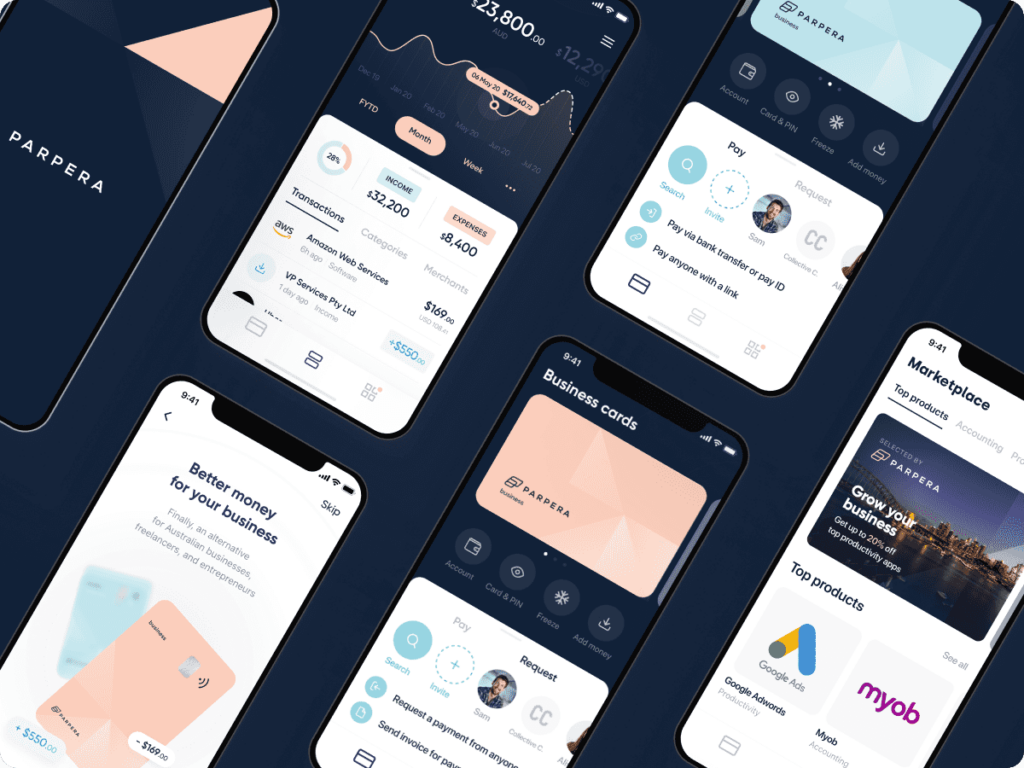

Parpera

If you ride solo, Parpera is the latest all-in-one app that makes banking, invoicing, and international card payments a breeze for sole traders, freelancers, entrepreneurs and workers in the gig-economy.

Parpera, which translates to “fair wallet” in Latin, has digital wallet, debit card, invoicing, payments, cash, and tax management capabilities and essentially operates just like a bank, without actually being one.

Parpera have partnered with Railspay, which sits under Railsbank in Europe who have a banking-as-a-service partnership with a neobank (a digital bank for those not up with the lingo!) called Volt. The money that comes in and out of Parpera sits on the Volt Bank balance sheet which is guaranteed by the government, providing trust and peace of mind to Parpera users.

The team at Parpera have also just announced their partnership with Xero, which scores points with us any day of the week.

If you have any questions about the above apps or want some advice on incorporating tech into your business, give us a call. We’d love to geek out with you!