Our services

Our personalised service is what sets us apart – lots of people can run the numbers but not many take the time to understand and support each client, case-by-case.

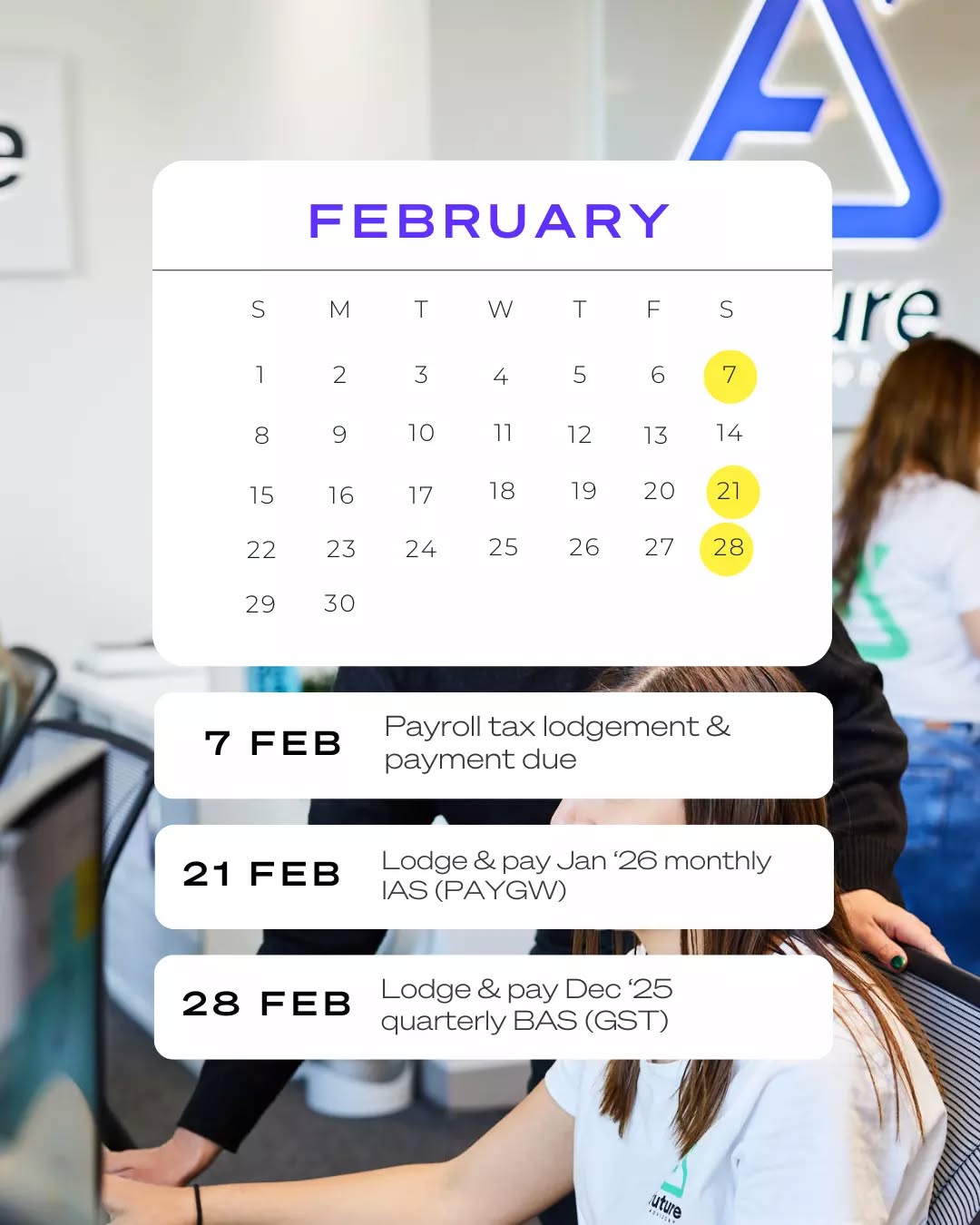

Accounting and Tax

We simplify the accounting process so you understand exactly where your money is going.

Bookkeeping

Don’t have the time or know-how to balance your books?

We can do it for you.

Financial Planning

Whatever your financial future looks like, we’re committed to helping you build it.

Mortgage Broking

Take the unknown out of loans with an expert to guide you through the process.

Welcome

to team future

Number crunching, tech loving, gin drinking, footy kicking nerds that are here because they *love* helping people.

AWARD WINNING

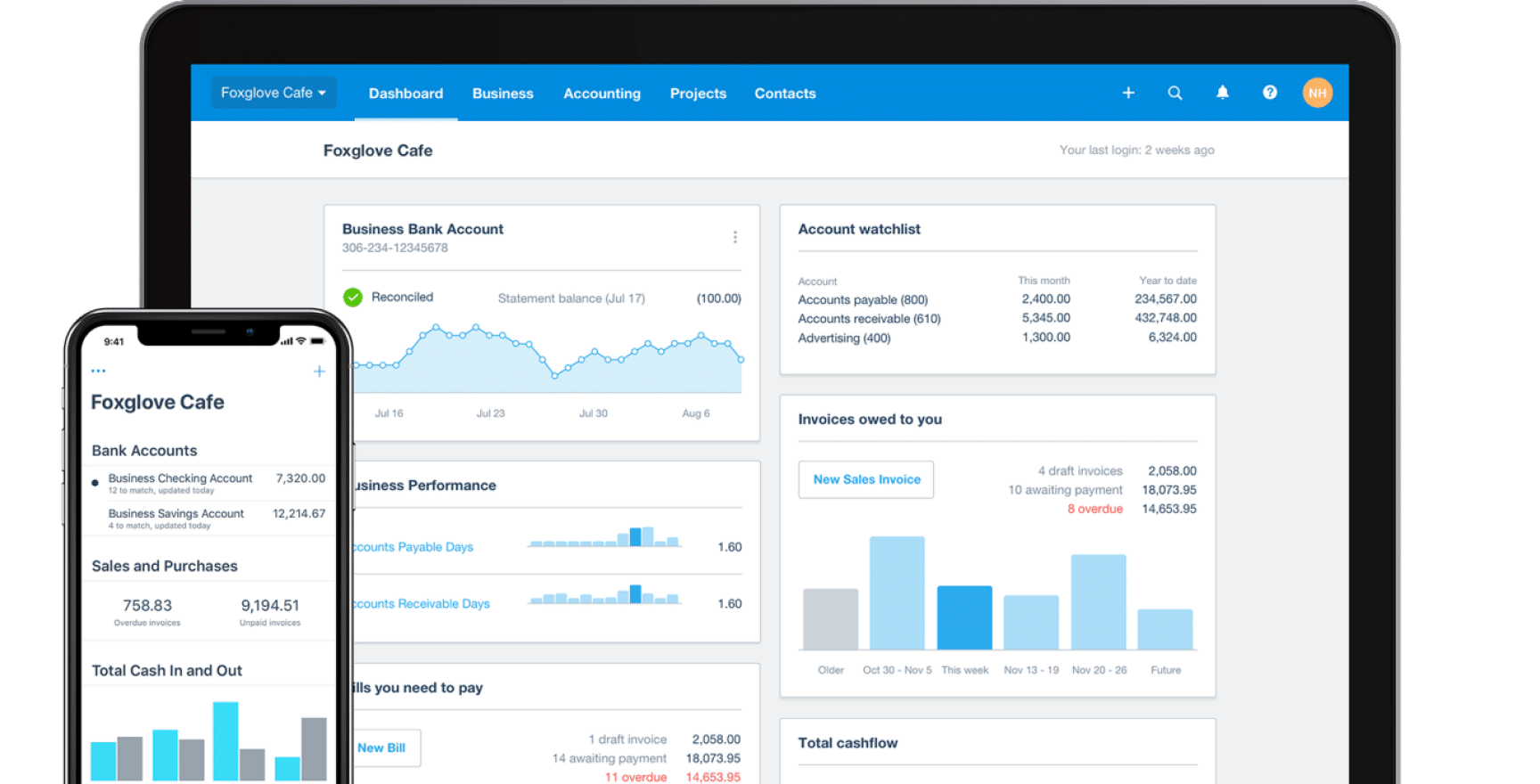

Xero Accounting Partner of The Year

Our love affair with Xero is akin to Elizabeth & Mr. Darcy: requited and bound for life. To achieve this illustrious industry award within our first year of business is something we’re very proud of.

What clients

say about us

The team at Future Advisory have been champions at giving us invaluable advice to help us make financially informed decisions to grow our business to where we are today. We can’t thank and recommend the team enough!

Future Advisory have become an integral part of my wider team. They say outsource what you aren’t good at and that wisdom couldn’t have worked better for my books. Future are never too busy to answer my questions; they’re reliable, skilled, and importantly, great people

The Future Advisory team have made it an absolute pleasure to do simply beautiful business. The traditional accounting cobwebs have been dusted away and their forward thinking fresher holistic approach, where a team of number crunching professionals look at your file and data, tailoring the critical information you need to know as a small business owner. Their services have freed up my time to do what I do best and that’s being with my customers.

Subscribe to our newsletter

Thinking about your financial future? Sign up to our newsletter for the latest news, accounting tips, FA team antics and future-proofing financial advice.

Follow us on the gram!

@future.advisory